Introduction

Lead generation is a crucial aspect of growing a wealth-management company. While traditional marketing methods may yield limited results, implementing effective lead-generation strategies can bring in a steady stream of qualified leads. In this comprehensive guide, we will explore the top lead-generation strategies for wealth management companies and provide you with actionable tips to attract and convert potential clients.

Fundamentals of Lead Generation in Wealth Management

Generating leads in wealth management means finding and attracting people who might be interested in financial services. To do this effectively, you must first understand your target audience—what they want, what they enjoy, and what challenges they confront. So, let’s explore the fundamentals of best lead generation practices:

1. Referral Program: Implementing a referral program in wealth management can be a game-changer. Encourage satisfied clients to refer friends and family by offering incentives or exclusive benefits, fostering a cycle of trust and expanding your client base organically.

2. Identify Your Target Audience: Precision in targeting is crucial. Define your ideal client persona based on demographics, financial goals, and pain points. Tailoring your lead generation efforts to resonate with this audience enhances conversion rates and fosters stronger client relationships.

3. Lead Generation Metrics: Track key metrics like conversion rates, cost per lead, and lead quality to evaluate the effectiveness of your strategies. Analyzing these metrics enables continuous optimization, ensuring maximum ROI from your lead generation efforts in wealth management.

4. Leverage Email Marketing: Craft personalized and value-driven email campaigns to nurture leads and build credibility. Share insights, investment tips, and updates on market trends to establish expertise and keep potential clients engaged throughout their customer journey.

5. Host an Event: Hosting educational seminars, workshops, or webinars positions your firm as a thought leader in wealth management. Provide valuable insights, address common concerns, and offer attendees the opportunity to engage with your team, fostering trust and generating high- quality leads.

6. Score Your Leads: Implement a lead scoring system to prioritize prospects based on their engagement level, demographics, and readiness to invest. This ensures your team focuses resources on leads with the highest potential to convert, optimizing efficiency and increasing conversion rates.

7. Create an Online Community: Establishing an online community through forums or social media groups cultivates a sense of belonging among clients and prospects. Encourage discussions, share valuable content, and offer expert advice to foster trust and attract new leads to your wealth management services.

8. Follow-Up: Promptly follow up with leads to maintain momentum and address any lingering doubts or questions. Personalized follow-up communication demonstrates your commitment to client satisfaction and increases the likelihood of converting leads into loyal clients.

9. Publish a Blog: Maintain an informative and regularly updated blog covering topics relevant to wealth management, such as investment strategies, retirement planning, and market insights. Publishing valuable content not only attracts organic traffic but also showcases your expertise and builds trust with potential clients.

10. Social Media Ads: Utilize targeted advertising campaigns to reach specific demographics interested in wealth management. Tailor your ad content to address pain points, highlight unique selling propositions, and drive traffic to dedicated landing pages optimized for lead capture.

11. Utilize Social Media: Actively engage with your audience on social media platforms by sharing valuable content, participating in discussions, and providing timely responses to inquiries. Leveraging social media channels strengthens brand visibility, fosters trust, and generates leads for your wealth management firm.

12. Run PPC Ads: Incorporate Pay-Per-Click (PPC) advertising into your lead generation strategy to target high-intent prospects actively searching for wealth management services. Craft compelling ad copy and utilize precise keyword targeting to maximize visibility and drive qualified leads to your website or landing pages.

Decade of Success

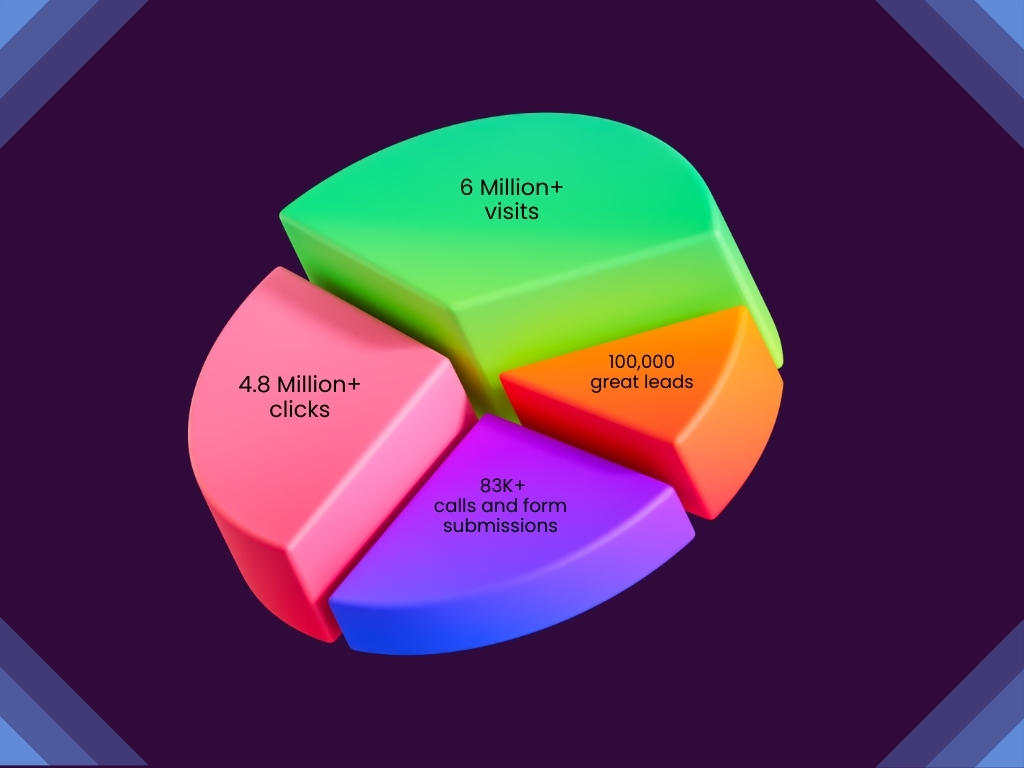

Looking back on the last ten years, our wealth management client’s journey has been pretty remarkable. We’ve been super successful in finding over 100,000 great leads for our valuable clients—people interested in what we offer. Our online presence has been a big hit, with a whopping 6 Million+ visits to their website. This just goes to show how much people like what we’re doing online.

When it comes to online ads, we’ve been rocking it! We got an amazing 4.8 Million+ clicks on our ads from places like search engines, social media, and other online displays. That’s a lot of people checking us out and liking what they see. It’s not just about clicks; our smart strategies make sure our content is right on target in the online world.

And let’s not forget about our search campaigns, where people find us when they’re looking. We’ve had a total of 83K+ calls and form submissions. That means lots of folks are reaching out and connecting with us because they like what we’re offering. So, as we celebrate this “Decade of Success,” it’s all about our dedication to smart ideas, using data wisely, and always trying to be the best at making wealth management easy for everyone.

Web Traffic Mastery

In the realm of wealth management, Web Traffic Mastery stands out as a crucial driver of client acquisition. Employing Search Engine Optimization (SEO), we enhance your online visibility, ensuring your financial expertise ranks prominently. Our content marketing excellence, coupled with social media dominance, fosters trust and positions your firm as a thought leader. Precision paid advertising amplifies your services to the right audience. Web Traffic Mastery isn’t just about numbers; it’s about forging meaningful connections. By deploying top-tier strategies, we not only elevate visibility but also establish your firm as the go-to destination for comprehensive wealth management solutions.

Ad Campaign Achievements

Effective advertising campaigns stand as the linchpin for success in the competitive landscape of wealth management. Beyond boosting brand visibility, these campaigns play a pivotal role in cultivating a robust pipeline of potential clients. In the digital age, strategic ad placement across Search, Social, and Display platforms is instrumental in reaching and engaging target audiences. A well-crafted campaign not only generates leads but also establishes a brand’s credibility and fosters trust, essential components in the nuanced world of wealth management.

Here at InstaServ, we take pride in our exceptional expertise. We’ve earned an impressive 4.8 Million+ clicks for our clients from carefully crafted campaigns across Search, Social, and Display Ads. Our experienced team combines industry know-how with the latest strategies to ensure that each campaign not only grabs attention but also turns clicks into meaningful leads. With our skills, your wealth management business can thrive online, making meaningful connections with the right audience.

Search Campaigns

When it comes to wealth management, the role of Search Campaigns is crucial in reaching and converting potential clients. We understand the significance of strategic Search Campaigns and employ advanced methods to ensure their effectiveness.

Our approach to Search Campaigns has proven highly successful, resulting in an impressive track record of 83K+ conversions, including both calls and form submissions. This numerical achievement highlights our expertise in using search engine platforms to seamlessly connect with potential clients. Through thorough keyword research, compelling ad creatives, and data-driven analysis, we consistently deliver tangible outcomes, propelling your wealth management business to new heights. Trust us to not only meet but exceed your expectations in the ever-evolving landscape of lead generation.

Our approach to Search Campaigns has proven highly successful, resulting in an impressive track record of 83K+ conversions, including both calls and form submissions. This numerical achievement highlights our expertise in using search engine platforms to seamlessly connect with potential clients. Through thorough keyword research, compelling ad creatives, and data-driven analysis, we consistently deliver tangible outcomes, propelling your wealth management business to new heights. Trust us to not only meet but exceed your expectations in the ever-evolving landscape of lead generation.

Lead Generation Strategies

In the realm of Wealth Management, implementing cutting-edge lead-generation strategies is paramount to sustained success. A multifaceted approach is essential, and the following strategies can significantly enhance your lead-generation efforts:

1. Personalized Marketing:

Overview: Personalized marketing involves tailoring your outreach efforts to the individual preferences and characteristics of potential clients. This strategy acknowledges that one size does not fit all when it comes to financial services.

Steps:

- Data Collection: Gather information on client preferences, investment history, and financial goals.

- Segmentation: Group clients based on similarities to create targeted campaigns.

- Customized Content: Develop personalized emails, newsletters, and offers for each segment.

- Feedback Loop: Use client feedback to continually refine and improve personalization.

Example: A wealth management firm could use personalized marketing by sending targeted emails to clients based on their investment preferences. For instance, if a client has shown interest in sustainable investing, the firm might send a personalized newsletter featuring the latest trends and opportunities in the realm of sustainable finance.

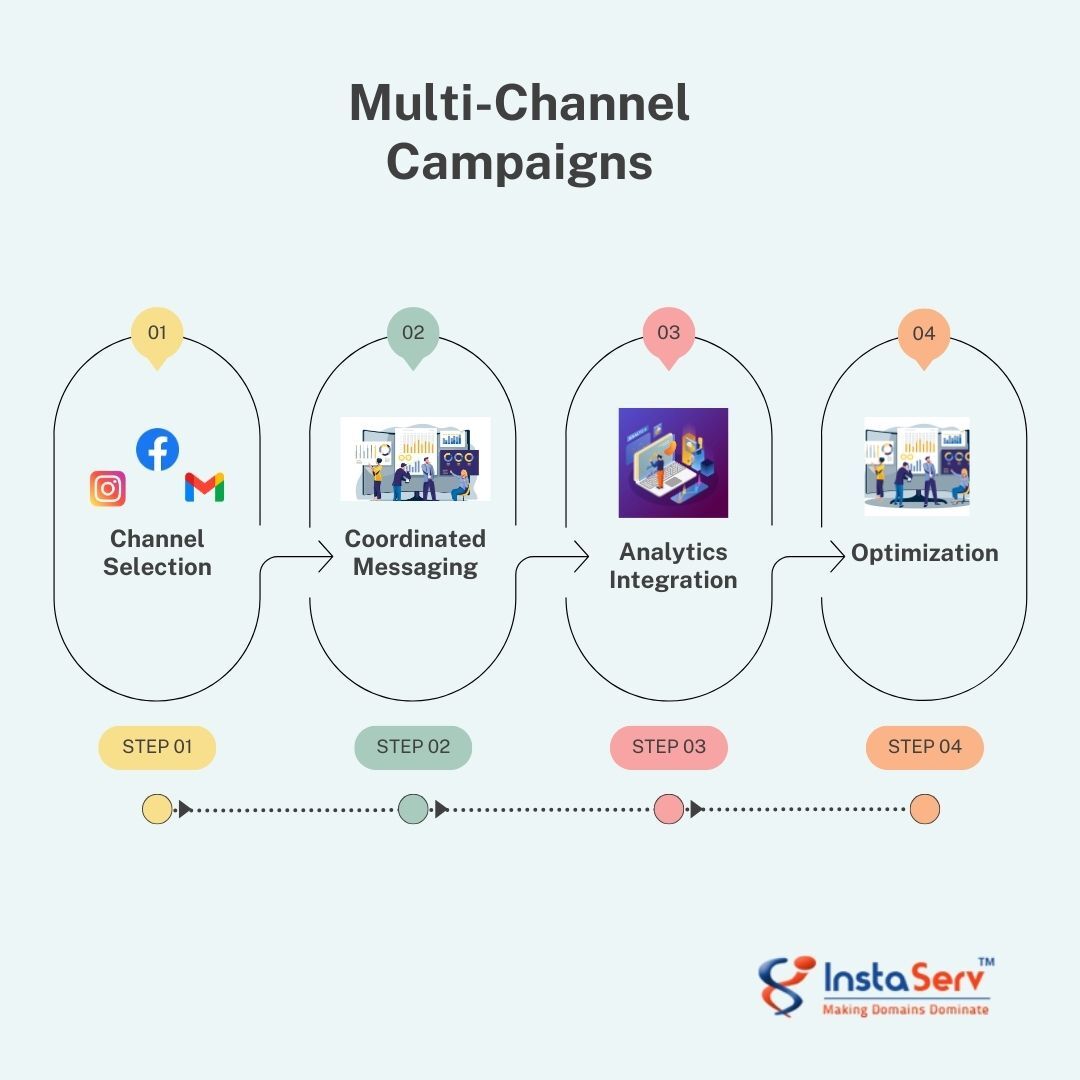

2. Multi-Channel Campaigns:

Overview: Multi-channel campaigns involve reaching potential clients through various platforms, ensuring a consistent and cohesive message across all channels.

Steps:

Steps:

- Channel Selection: Identify relevant platforms such as email, social media, and online advertising.

- Coordinated Messaging: Develop a unified message to reinforce brand identity.

- Analytics Integration: Use analytics tools to track campaign performance across channels.

- Optimization: Adjust campaigns based on performance data for continuous improvement.

Example: A wealth management firm could run a multi-channel campaign by combining LinkedIn ads with targeted email outreach. The LinkedIn ads could highlight the firm’s expertise in retirement planning, directing users to a dedicated landing page where they can learn more and subscribe to the firm’s newsletter.

3. Content Marketing Excellence:

Overview: Content marketing involves creating and distributing valuable, relevant content to attract and engage a target audience.

Steps:

Steps:

- Content Strategy: Develop a plan outlining the types of content to be created (blog posts, whitepapers, webinars).

- Expert Insights: Showcase the firm’s expertise through informative and educational content.

- SEO Optimization: Ensure content is optimized for search engines to reach a broader audience.

- Consistency: Maintain a consistent publishing schedule to keep the audience engaged.

Example: A wealth management firm might create a comprehensive guide on tax-efficient investment strategies. This guide could be promoted through blog posts, social media, and email newsletters, establishing the firm as a trusted source of valuable information.

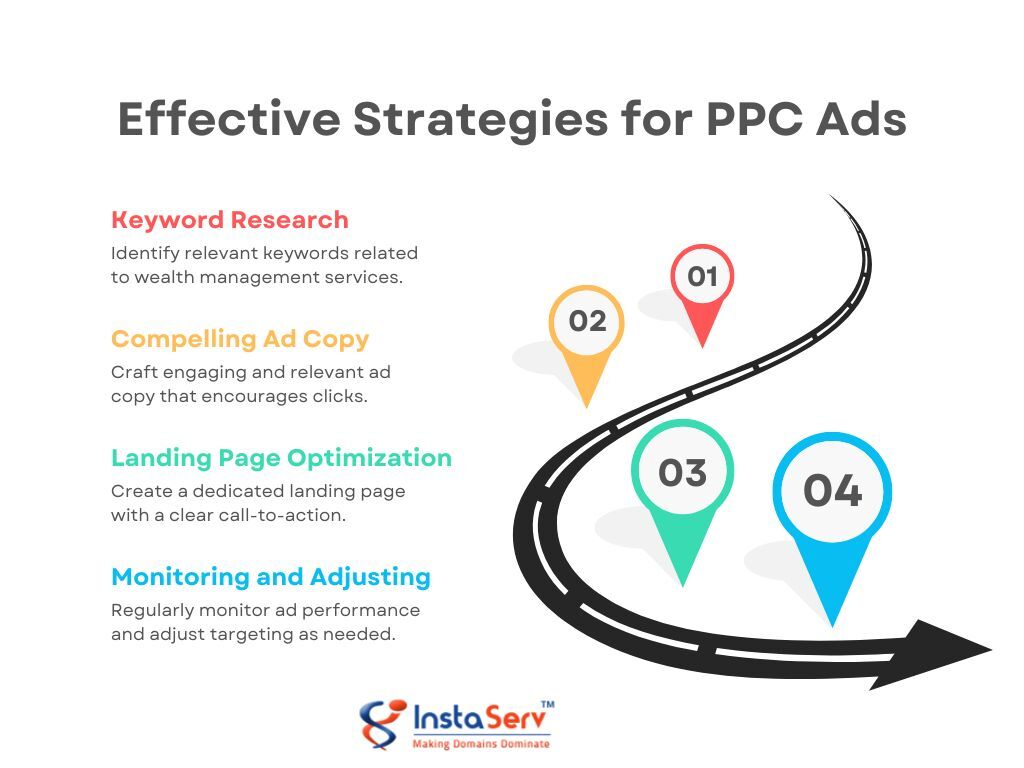

4. Run Effective PPC Ads:

Overview: Pay-per-click advertising involves placing ads on search engines or social media platforms and paying only when a user clicks on the ad.

Steps:

Steps:

- Keyword Research: Identify relevant keywords related to wealth management services.

- Compelling Ad Copy: Craft engaging and relevant ad copy that encourages clicks.

- Landing Page Optimization: Create a dedicated landing page with a clear call to action.

- Monitoring and Adjusting: Regularly monitor ad performance and adjust targeting as needed.

Example: A wealth management firm could run PPC ads targeting keywords like “retirement planning” or “investment strategies.” The ad copy could highlight the firm’s unique approach, leading users to a landing page where they can schedule a consultation.

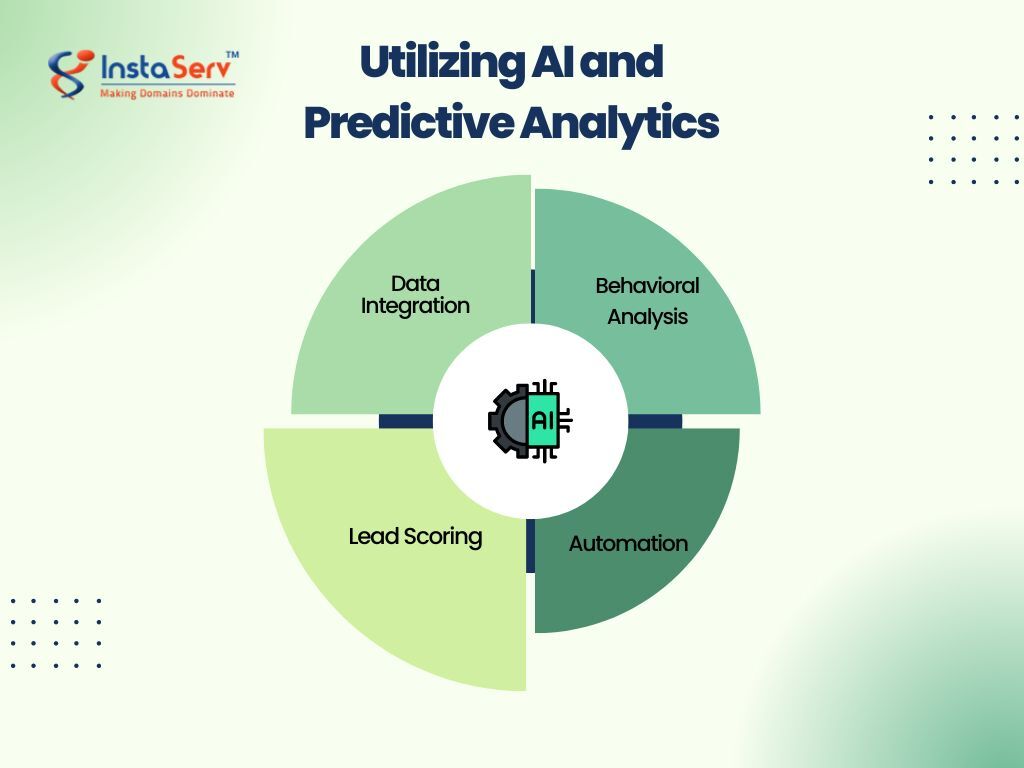

5. Utilizing AI and Predictive Analytics:

Overview: Leveraging artificial intelligence and predictive analytics involves using advanced technologies to analyze data, predict client behavior, and automate lead scoring.

Steps:

Steps:

- Data Integration: Integrate AI systems with existing client data and CRM systems.

- Behavioral Analysis: Use AI to analyze client behavior and identify patterns.

- Lead Scoring: Implement predictive analytics to assign scores to potential leads.

- Automation: Utilize AI-powered tools, such as chatbots, to engage with website visitors.

Example: A wealth management firm could implement a chatbot on its website that uses AI to engage visitors, collect information about their financial goals, and qualify leads based on predefined criteria. The AI system could prioritize leads based on their likelihood to convert.

6. Strategic Partnerships:

Overview: Strategic partnerships involve collaborating with other businesses in the financial ecosystem to expand reach and enhance service offerings.

Steps:

Steps:

- Identify Partners: Look for businesses that complement your wealth management services.

- Mutual Referrals: Establish a referral system where partners refer clients to each other.

- Coordinated Marketing: Develop joint marketing efforts to reach a broader audience.

- Shared Resources: Pool resources and expertise for mutual benefit.

Example: A wealth management firm could form a strategic partnership with a legal or accounting firm. This partnership could involve joint seminars or webinars on comprehensive financial planning, where each firm brings its expertise to the table, attracting a wider audience and generating leads through referrals.

Incorporating these strategies into your wealth management lead generation plan can create a comprehensive and effective approach that aligns with the evolving needs of potential clients in the financial services sector.

Impact of SEO and Ads in Finding More Clients for Wealth Management

When it comes to growing your wealth management business, it’s crucial to attract new clients. Two powerful tools for doing this online are Search Engine Optimization (SEO) and online ads. Let’s explore practical strategies and real-life examples of how these methods can significantly boost client acquisition for wealth management solutions.

SEO: Boosting Your Website’s Visibility

Implementing a strong SEO strategy means making sure your website appears when people search online. Consider a hypothetical wealth management firm specializing in retirement planning.

Keywords Optimization: The firm strategically incorporated keywords like “retirement planning,” “financial help for retirees,” and “smart retirement investments” into their website. This made their site show up at the top when people searched for these terms, attracting more visitors interested in retirement planning.

Quality Content Creation: The firm regularly published helpful articles such as “Maximizing Your Social Security Benefits in Retirement” and “Tax-Smart Strategies for Retirement Income.” This not only showcased their expertise but also drew in individuals actively seeking financial guidance.

Quality Content Creation: The firm regularly published helpful articles such as “Maximizing Your Social Security Benefits in Retirement” and “Tax-Smart Strategies for Retirement Income.” This not only showcased their expertise but also drew in individuals actively seeking financial guidance.

Local SEO: If your wealth management business serves a specific location, optimize for local searches. For instance, if your firm operates in San Francisco, include keywords like “wealth management San Francisco” to connect with potential clients in your area.

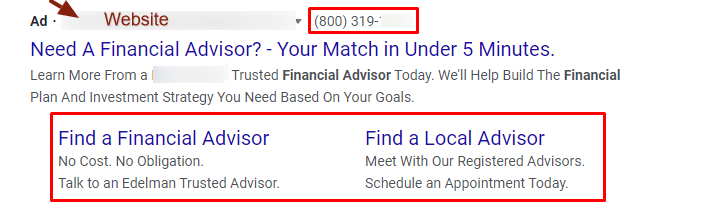

PPC Ads: Grabbing Immediate Attention

PPC Ads: Grabbing Immediate Attention

Online ads provide a quick and targeted approach to reaching potential clients. Let’s take the example of a wealth management firm focusing on investment strategies.

Strategic Keyword Targeting: This firm used online ads on platforms like Google Ads to reach people searching for terms like “investment planning,” “low-risk investments,” and “wealth preservation strategies.” This helped them get noticed by individuals actively looking for wealth management services.

Compelling Ad Extensions: The firm added extra information to their ads, such as “Free Investment Consultation” and “Customized Portfolio Analysis.” These additions not only increased click-through rates but also encouraged prospective clients to take the next step.

Remarketing: If someone visits your website but doesn’t become a client, use remarketing ads to reconnect with them. For example, show ads to those who visited your retirement planning page, reminding them of your expertise and encouraging them to reach out.

By incorporating these SEO and ads tactics into your lead generation strategy, you can significantly enhance your wealth management business’s online presence and attract a steady stream of clients actively seeking financial guidance.

By incorporating these SEO and ads tactics into your lead generation strategy, you can significantly enhance your wealth management business’s online presence and attract a steady stream of clients actively seeking financial guidance.

Future of Lead Generation in Wealth Management

Looking forward, the way we find potential clients in wealth management is changing. Technology will make things more automated, helping financial professionals focus on building relationships. Personalization will become even better, tailoring advice to what individuals need. We’ll see more AI assistants, like smart helpers, providing quick answers and making communication smoother. Also, there will be a stronger focus on using data ethically and transparently, respecting people’s privacy. These changes are important for wealth managers who want to stay ahead, connect with clients better, and keep growing.

Conclusion

In the world of helping people manage their money, finding the right clients is super important. At InstaServ, we’ve had a great ten years, getting over 100,000 people interested in what we do. Our online stuff, like ads and websites, has been a big hit, with millions of people checking us out.

We’re proud of our ad campaigns; they’ve brought us a whopping 49 million clicks from places like search engines and social media. This means a lot of people like what they see and want to know more. Our secret? Smart ideas, using data wisely, and always trying to be the best in making money management easy for everyone.

Our lead generation strategies, like Web Traffic Mastery and Search Campaigns, have been key. We use personalized marketing, smart advertising, and even artificial intelligence to find the right clients for wealth management companies. Looking ahead, technology will make things even better, focusing on relationships and respecting people’s privacy. At InstaServ, we’re all about helping wealth management companies generate maximum leads and connect in a way that suits them best.

FAQ’s

What are the 4 L's of a lead generation strategy?

The 4 L’s of a lead generation strategy typically refer to Lead Capture, Lead Magnet, Lead Nurture, and Lead Conversion. Lead Capture involves capturing potential client information through forms or landing pages. Lead Magnet refers to offering valuable content or incentives to entice prospects to provide their details. Lead Nurture involves engaging and nurturing leads through personalized content and communication. Finally, Lead Conversion focuses on converting nurtured leads into clients through targeted sales efforts.

How do you generate leads for wealth management?

Generating leads for wealth management involves various strategies tailored to the industry’s unique needs. These include implementing referral programs, hosting educational events or webinars, leveraging email marketing campaigns, utilizing social media advertising, optimizing for local SEO, and employing PPC ads targeting high-intent prospects actively seeking wealth management services. Each strategy aims to attract, capture, and convert potential clients interested in financial planning and investment management.

What is lead generation in financial services?

Lead generation in financial services encompasses the process of identifying, attracting, and converting potential clients interested in financial products and services. This includes activities such as content marketing, referral programs, networking events, and digital advertising campaigns specifically tailored to target individuals or businesses seeking financial advice, investment opportunities, or insurance services.

How do you generate finance leads?

Generating finance leads involves implementing targeted marketing strategies to reach individuals or businesses seeking financial products or services. This may include creating informative content relevant to financial planning, investment strategies, or retirement planning to attract organic traffic. Additionally, utilizing paid advertising channels, such as PPC ads and social media ads, can help target specific demographics actively searching for finance-related solutions. Networking, referrals, and partnerships within the finance industry can also be valuable sources of leads.

Do financial advisors pay for leads?

While some financial advisors may opt to pay for leads through various lead-generation services or platforms, many prefer to generate leads organically through referrals, networking, and targeted marketing efforts. Paying for leads can be a viable option for advisors looking to supplement their lead generation efforts, but it’s essential to carefully evaluate the quality and cost-effectiveness of paid leads to ensure a positive return on investment.

PPC Ads: Grabbing Immediate Attention

PPC Ads: Grabbing Immediate Attention